Insurance Services – Enterprise Business Transformation

An Introduction To Our Insurance Services Platform

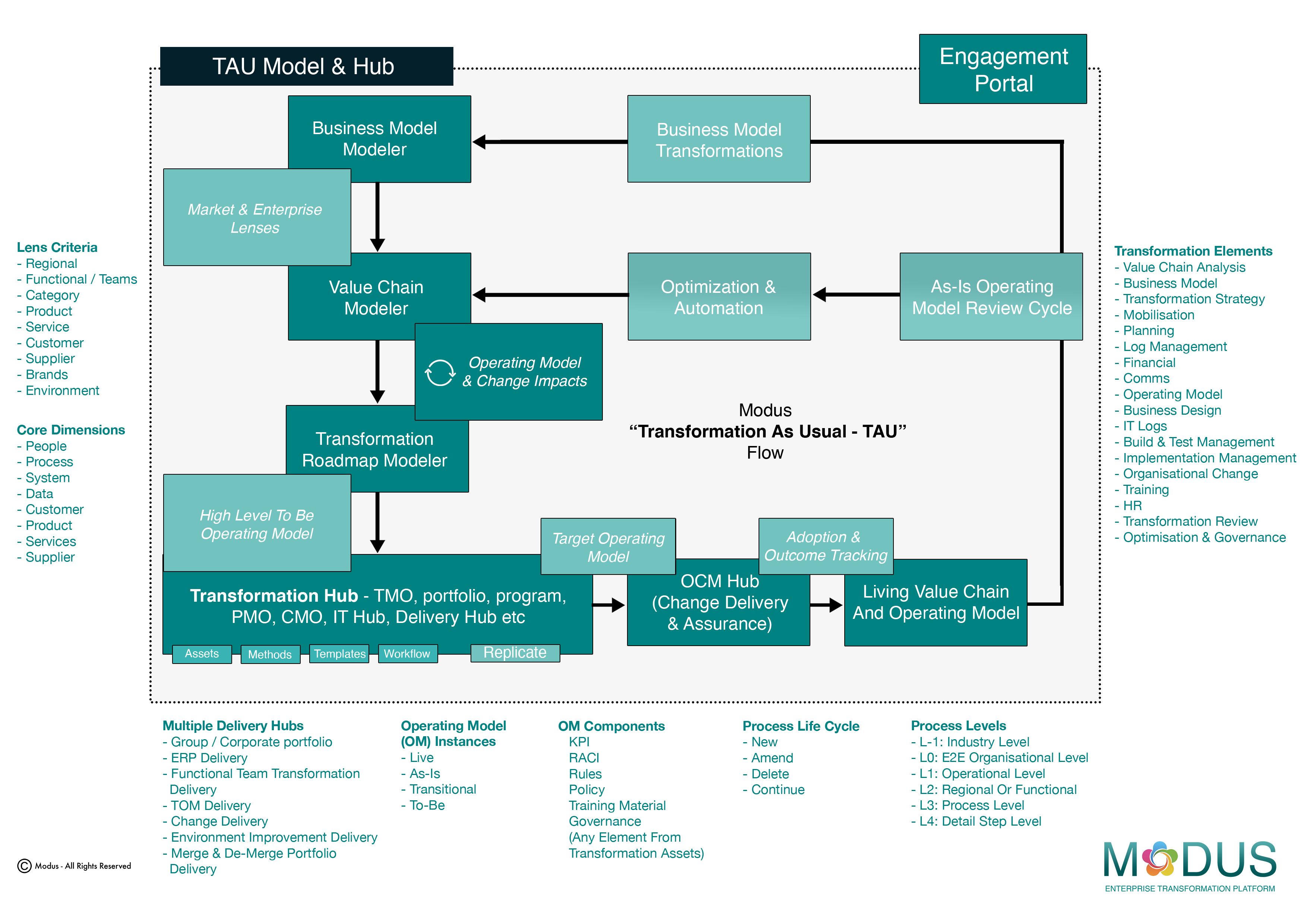

Modus Business Transformation Core Modules

Building, Driving and Sustaining your Business Transformation and embedding a 'Transformation As Usual' platform.

01 - Business Model Management - Manage and Adapt

Embrace the Business Model Management Hub to navigate and thrive in the ever-evolving business landscape with confidence and clarity.

Key Features:

• Customer-Centric Approach: Modern insurance models focus on

understanding customer needs through personalized products, real-time

support, and customized policies that match life stages or specific risks.

• Risk Management and Assessment: Effective risk evaluation tools,

predictive modeling, and data analytics are central to managing and pricing r

risks accurately in insurance products.

• Digital Transformation: Insurance business models incorporate digital tools,

AI, machine learning, and data analytics for claims processing, underwriting,

customer service, and fraud detection.

Importance:

• Adaptability to Market Changes: With increased competition, changing

regulations, and technological advancements, insurers need robust business

model management to stay relevant.

• Customer Retention and Acquisition: A well-managed business model

prioritizes customer engagement and retention by providing personalized

services, better experiences, and quicker claims resolutions.

• Operational Efficiency: Streamlining processes such as underwriting, claims

handling, and customer service through automation and data-driven

decision-making reduces costs and increases profitability.

Benefits:

• Increased Profitability: Streamlined operations, efficient risk management,

and personalized products improve profit margins by reducing operational

costs and minimizing risk-related losses.

• Enhanced Customer Experience: Digital transformation leads to faster

claims processing, responsive customer service, and products that better

meet individual needs, improving customer loyalty and satisfaction.

• Scalability and Growth: With scalable business models, insurers can expand

into new markets, introduce innovative product lines, and leverage

partnerships to drive growth.

Benefits:

• Operational Efficiency: By streamlining workflows and reducing process

bottlenecks, the value chain modeler helps reduce costs, speed up

processes, and improve overall operational efficiency.

• Enhanced Customer Experience: By visualizing customer interactions

across the value chain, insurers can enhance customer service, reduce

claims processing times, and create personalized products that meet

customer demands.

• Faster Time-to-Market: The ability to model and test new products and

services ensures that insurers can respond to market changes more quickly

and bring new offerings to market faster.

02 - The Value Chain Modeler - Manage and Adapt

Harness the power of the Value Chain Modeler to drive your business forward with clarity, precision, and confidence.

Key Features:

• End-to-End Process Visualization: The Value Chain Modeler provides a

comprehensive view of the entire insurance value chain, from product

development and underwriting to claims processing and customer service.

• Data Integration: It integrates various data points across different functions

(e.g., actuarial, claims, customer data) to create a unified, real-time view of

operations, enabling better decision-making.

• Risk and Compliance Management: The modeler helps track and map

compliance requirements and risks at every stage of the value chain,

ensuring adherence to regulatory standards.

• Digital Transformation Enablement: It facilitates the integration of digital

technologies such as AI, IoT, and machine learning into traditional insurance

processes like underwriting, claims, and policy administration.

Importance:

• Streamlined Operations: By visualizing and managing every component of

the value chain, insurers can identify inefficiencies, eliminate redundancies,

and streamline operations for greater productivity.

• Improved Risk Management: Mapping risks and bottlenecks at each stage of

the value chain enables insurers to take proactive measures, improving their

ability to mitigate financial, operational, and regulatory risks.

• Data-Driven Decision Making: By integrating real-time data across

departments, the value chain modeler allows insurers to make informed,

data-driven decisions regarding product pricing, customer targeting, and

claims management.

03 - The Operating Model - Organize and Sustain

Utilize the Operating Model to keep your business operations organized, efficient, and adaptable, ensuring long-term success and growth.

Key Features:

• Strategic Alignment: The operating model connects the overall business

strategy to day-to-day operations, ensuring that every function (underwriting,

claims, sales, etc.) aligns with the insurer's goals and regulatory

requirements.

• Core Functions Framework: It structures key operational areas such as

underwriting, policy administration, claims management, customer service,

and distribution channels, outlining how these areas interact and support

each other.

• Digital Integration: A modern insurance operating model incorporates digital

tools like automation, AI, and data analytics into core processes, enhancing

customer interactions, risk assessment, and operational efficiency.

Importance:

• Operational Efficiency: A clear and well-structured operating model helps

insurers streamline processes, reducing complexity and eliminating

inefficiencies, which leads to better use of resources and cost reductions.

• Strategic Execution: The operating model ensures that the company’s

strategic vision, such as becoming more customer-centric or digitally

transformed, is translated into actionable steps within day-to-day operations.

• Regulatory Compliance: As regulations in the insurance industry evolve, the

operating model ensures that compliance processes are embedded in all

operations, reducing the risk of non-compliance and penalties.

Benefits:

• Improved Profitability: Streamlining operations and optimizing resource

allocation helps reduce operational costs, minimize waste, and increase

profit margins across the insurance business.

• Enhanced Customer Experience: A customer-centric operating model

ensures quicker claims processing, personalized service, and efficient policy

management, resulting in higher customer satisfaction and loyalty.

• Faster Decision-Making: By integrating data analytics and real-time reporting

into the operating model, insurers can make faster, data-driven decisions

regarding underwriting, pricing, and claims management.

Benefits:

• Improved Decision-Making: The real-time visibility into all transformation

initiatives enables leaders to make informed, data-driven decisions,

optimizing portfolio performance and aligning efforts with strategic priorities.

• Increased Efficiency: By centralizing transformation assets and streamlining

resource allocation, organizations can reduce redundancies, speed up

project delivery, and lower operational costs.

• Enhanced Collaboration: The module fosters cross-departmental

collaboration by providing a unified platform where stakeholders can share

insights, tools, and updates, leading to improved communication and

coordination.

04 - The Transformation Assets and Portfolio Module - Discover and Transform

Leverage the Transformation Assets and Portfolio Module to drive successful and sustainable business transformations with clarity and efficiency.

Key Features:

• Centralized Asset Repository: The module stores all transformation-related

tools, templates, methodologies, and frameworks in a single, accessible

location, ensuring consistency and efficiency across transformation

initiatives.

• Portfolio Management Dashboard: Provides a real-time overview of all

ongoing transformation projects, tracking progress, resource allocation,

milestones, and key performance indicators (KPIs) across the portfolio.

• Template and Methodology Standardization: Offers out-of-the-box

transformation methods, templates, and frameworks for tasks such as

project planning, risk management, and change management, ensuring a

structured approach.

• Scenario Planning and Simulation: Supports "what-if" analysis and scenario

modeling to help organizations assess the impact of different strategic

decisions on their transformation portfolio.

Importance:

• Strategic Alignment: Ensures that all transformation projects are aligned with

the overall business strategy, allowing organizations to prioritize efforts that

contribute directly to strategic objectives.

• Holistic Transformation Management: By integrating all transformation

projects under one portfolio, the module offers a holistic view of the

organization's transformation efforts, helping management make informed,

strategic decisions.

• Efficiency and Consistency: With standardized tools, methodologies, and

templates, the module ensures consistency across transformation projects,

leading to improved efficiency and smoother execution.

• Value Chain Analysis

• Business Model Analysis

• Transformation Strategy

• Transformation Mobilisation

• Planning Management

• Transformation Log Management

• Financial Management

• Communication Management

• Operating Model Management

• Process Design Management

• IT Design Management

• Build and Test Management

• Implementation Management

• Change Management

• Personal Development Assessments

• Training Management

• Organizational Design Management

• Transformation Review

• Optimization and Governance

05 - Organizational Change Management - Unite and Thrive

Utilize the Organizational Change Management module to unite your team and thrive through effective, sustainable change.

Key Features:

• Change Impact Assessment: OCM in insurance includes tools to assess

how changes—such as new regulations, technologies, or products—will

impact different functions (e.g., underwriting, claims, customer service) and

employees within the organization.

• Stakeholder Engagement: Ensures that key stakeholders, including

employees, agents, customers, and regulatory bodies, are actively involved

and informed throughout the change process.

• Communication and Training Plans: Develops structured communication

strategies to keep all parties informed about upcoming changes and

comprehensive training programs to equip employees with the necessary

skills to adapt to new processes and systems.

Importance:

• Smooth Implementation of Changes: The insurance industry faces constant

regulatory updates, technological shifts, and evolving customer

expectations. OCM ensures that these changes are implemented smoothly

and without disruption to core operations.

• Adaptation to Technological Disruptions: With the rise of digital tools like AI,

automation, and data analytics, OCM helps insurers transition to new

technologies while minimizing resistance and ensuring employees are well-

equipped to handle new systems.

• Regulatory Compliance: Regulatory changes in insurance, such as data

protection laws and solvency regulations, require organizations to adapt

quickly. OCM helps ensure these changes are integrated without compliance

breaches.

Benefits:

• Increased Agility: OCM enables insurance companies to respond faster and

more effectively to market changes, regulatory demands, and customer

needs, allowing them to stay competitive.

• Reduced Resistance to Change: By actively managing employee concerns

and creating clear communication channels, OCM reduces resistance to

change and fosters a culture that embraces innovation.

• Improved Regulatory Compliance: OCM ensures that regulatory changes

are incorporated into business processes without disrupting daily operations,

reducing the risk of fines or legal issues.

Benefits:

• Increased Efficiency: Centralized communication and self-service features

reduce administrative burdens, freeing up resources for higher-value tasks

like customer service or strategic planning.

• Better Decision-Making: With access to real-time data, teams can make

informed, timely decisions that enhance customer service, optimize claims

handling, and improve underwriting accuracy.

• Enhanced Customer Engagement: Providing customers with easy access to

their policies, claims, and support increases their satisfaction and

engagement, fostering loyalty and retention.

06 - Engagement Hub - Share and Guide

Utilize the Engagement Hub to streamline your communication, enhance team collaboration, and guide your organization through successful transformations.

Key Features:

• Centralized Communication Platform: The Engagement Hub provides a

unified space where all stakeholders—employees, agents, policyholders,

and partners—can communicate, share updates, and access critical

information.

• Real-Time Collaboration: Enables seamless collaboration between different

departments (claims, underwriting, sales) and external partners (brokers,

reinsurers) in real-time, improving responsiveness and decision-making.

• Customizable Dashboards: Offers personalized dashboards that deliver role-

specific insights, such as customer service performance, claims processing

times, or policy updates, tailored to each user’s needs.

Importance:

• Enhanced Stakeholder Communication: In the insurance industry, involving

multiple stakeholders (customers, brokers, agents, partners) can be

complex.

• The Engagement Hub centralizes communication, ensuring clarity and

transparency.

• Improved Customer Experience: By providing policyholders with direct

access to their information and self-service tools, the hub helps streamline

processes such as claims filing and policy updates, improving the overall

customer experience.

• Alignment Across Teams: Insurance operations often span multiple functions

and geographies. The hub ensures that all teams—whether claims,

underwriting, or sales—are aligned and working towards common goals with

shared information.

Transformation As Usual Capability Model

Individual and Team Capability Development