Private Equity Services – Enterprise Business Transformation

An Introduction To Our Private Equity Services Platform

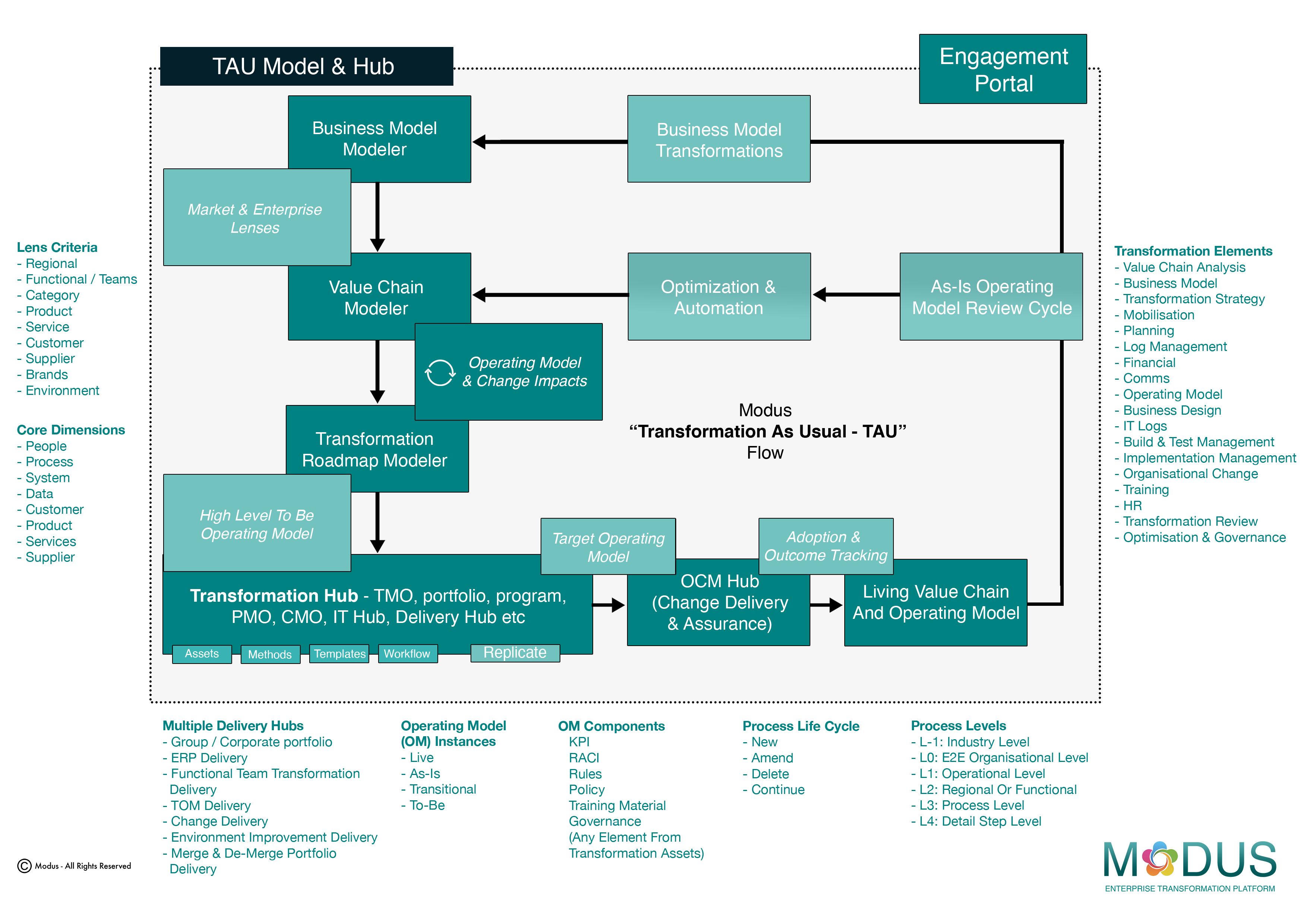

Modus Business Transformation Core Modules

Building, Driving and Sustaining your Business Transformation and embedding a 'Transformation As Usual' platform.

01 - Business Model Management - Manage and Adapt

Embrace the Business Model Management Hub to navigate and thrive in the ever-evolving business landscape with confidence and clarity.

Key Features:

• Value Creation Framework: A structured approach to identifying and

optimizing value drivers (e.g., revenue growth, operational efficiency) within

portfolio companies to maximize returns.

• Targeted Investment Strategies: Business model management helps in

defining specific investment theses, such as buy-and-build strategies,

turnaround opportunities, or sector-specific plays.

• Operational Due Diligence: Incorporates detailed analysis of operational

strengths, weaknesses, and scalability to ensure the business model aligns

with long-term growth potential.

• Risk Management and Mitigation: Proactively addresses risks associated

with the business model, such as market competition, regulatory shifts, or

technological disruption, ensuring portfolio resilience.

Importance:

• Maximizing Return on Investment (ROI): Business model management is

crucial for enhancing portfolio company performance and driving higher

returns for investors, a core objective of private equity.

• Strategic Alignment with Market Trends: Ensures that the business model of

portfolio companies is aligned with current and future market conditions,

allowing for better adaptation and sustainable growth.

• Risk Mitigation: A well-managed business model identifies and mitigates

operational and market risks, reducing the likelihood of underperformance or

financial loss.

Benefits:

• Enhanced Portfolio Performance: By optimizing the business models of

portfolio companies, private equity firms can significantly improve

operational efficiency, revenue streams, and profitability.

• Informed Investment Decisions: Effective business model management

provides insights into the scalability and growth potential of investment

targets, leading to more informed and strategic investment decisions.

• Faster Time-to-Value: With a well-structured business model, portfolio

companies can implement value creation plans faster, accelerating time-to-

value and allowing private equity firms to realize returns sooner.

Benefits:

• Increased Profitability: By streamlining operations, reducing costs, and

optimizing resource allocation, the Value Chain Modeler enhances

profitability for portfolio companies, ultimately leading to higher returns for

investors.

• Faster Value Creation: The modeler accelerates the process of identifying

and implementing value creation initiatives, enabling private equity firms to

achieve their growth and profitability targets more quickly.

• Improved Scalability: A well-optimized value chain allows portfolio

companies to scale efficiently, whether through organic growth, mergers,

acquisitions, or entering new markets.

• Data-Driven Insights: With real-time data and KPIs, private equity firms can

make data-driven decisions that optimize performance across the portfolio,

ensuring that resources are used effectively and strategically.

02 - The Value Chain Modeler - Manage and Adapt

Harness the power of the Value Chain Modeler to drive your business forward with clarity, precision, and confidence.

Key Features:

• End-to-End Business Process Mapping: The Value Chain Modeler provides

a detailed map of all operational processes within portfolio companies, from

production to customer delivery, identifying areas for improvement and

efficiency gains.

• Cost and Revenue Analysis: It tracks and analyzes costs, revenues, and

profit margins at every stage of the value chain, helping private equity firms

optimize resource allocation and improve overall financial performance.

• Operational Efficiency Tools: The modeler identifies inefficiencies,

redundancies, and bottlenecks across different functions (e.g., procurement,

production, distribution) to streamline operations and reduce operational

costs.

Importance:

• Value Creation: A Value Chain Modeler is crucial for identifying operational

improvements in portfolio companies, optimizing value drivers like cost

efficiency, product quality, and customer service, thereby driving higher

returns on investment (ROI).

• Operational Transparency: It provides private equity firms with full visibility

into portfolio company operations, helping them understand where resources

are being utilized, where inefficiencies exist, and how to drive better results.

• Strategic Decision-Making: By analyzing various parts of the value chain,

private equity firms can make informed strategic decisions on process

improvements, cost reduction, and resource allocation to improve profitability

and scalability.

03 - The Operating Model - Organize and Sustain

Utilize the Operating Model to keep your business operations organized, efficient, and adaptable, ensuring long-term success and growth.

Key Features:

• Strategic Alignment: Ensures that portfolio companies' operations are

aligned with the private equity firm's overarching goals, such as value

creation, scalability, and exit strategies.

• Portfolio Company Management Structure: Defines clear management

structures for each portfolio company, ensuring that roles and responsibilities

are well-defined across functions like finance, operations, and governance.

• Performance Monitoring and KPIs: Establishes a framework to monitor

portfolio performance through key performance indicators (KPIs), including

financial metrics, operational efficiency, and growth milestones.

Importance:

• Maximizing Value Creation: The operating model is critical for driving

operational improvements in portfolio companies, enhancing their value and

ensuring higher returns for investors during the holding period.

• Operational Efficiency: A structured operating model ensures that portfolio

companies function efficiently, eliminating redundancies, improving

processes, and aligning operations with the firm's financial and strategic

objectives.

• Risk Mitigation: By incorporating risk management into every aspect of the

operating model, private equity firms can proactively address financial,

operational, and compliance risks across their portfolio.

Benefits:

• Higher Returns on Investment (ROI): By improving operational efficiency

and aligning with strategic goals, portfolio companies generate higher

revenues, reduce costs, and become more valuable at exit, leading to higher

returns.

• Scalable Growth: A well-structured operating model supports rapid scaling of

portfolio companies, enabling expansion into new markets, increasing

production capacity, or acquiring new businesses.

• Improved Decision-Making: With real-time performance data and KPIs,

private equity firms can make informed decisions about resource allocation,

growth strategies, and potential risks, ensuring optimal portfolio

management.

Benefits:

• Accelerated Transformation Execution: By providing standardized

frameworks and real-time visibility into progress, the module enables faster

execution of transformation initiatives, helping portfolio companies achieve

their goals more quickly.

• Higher ROI for Investors: The module facilitates the optimization of

transformation projects, leading to improved operational performance,

increased profitability, and ultimately higher returns for private equity

investors.

• Enhanced Decision-Making: With scenario planning, performance tracking,

and risk management tools, the module supports data-driven decision-

making, allowing private equity firms to optimize resource allocation and

strategic planning.

04 - The Transformation Assets and Portfolio Module - Discover and Transform

Leverage the Transformation Assets and Portfolio Module to drive successful and sustainable business transformations with clarity and efficiency.

Key Features:

• Centralized Asset Repository: The module stores all tools, methodologies,

templates, and best practices related to transformation initiatives across

portfolio companies in a single, accessible location.

• Portfolio Performance Tracking: Offers real-time dashboards and metrics

that track the progress of transformation projects across multiple portfolio

companies, including financial performance, operational improvements, and

milestones achieved.

• Standardized Methodologies: Provides out-of-the-box frameworks for

managing and executing transformation strategies (e.g., operational

improvements, cost reductions, digital transformations) across portfolio

companies, ensuring consistency.

• Resource Allocation Optimization: Tracks the allocation of resources—

capital, human, and technological—across transformation projects, ensuring

optimal use of assets to drive value creation efficiently.

Importance:

• Maximizing Value Creation: The module plays a critical role in managing and

driving transformation initiatives that increase the operational and financial

value of portfolio companies, ensuring maximum returns for investors.

• Operational Efficiency: By standardizing processes and providing centralized

access to transformation assets, private equity firms can execute

transformation projects more efficiently, reducing waste and improving

execution speed.

• Strategic Alignment: The module ensures that all transformation efforts

across portfolio companies are aligned with the private equity firm’s overall

strategic goals, including growth, scalability, and readiness for exit.

• Value Chain Analysis

• Business Model Analysis

• Transformation Strategy

• Transformation Mobilisation

• Planning Management

• Transformation Log Management

• Financial Management

• Communication Management

• Operating Model Management

• Process Design Management

• IT Design Management

• Build and Test Management

• Implementation Management

• Change Management

• Personal Development Assessments

• Training Management

• Organizational Design Management

• Transformation Review

• Optimization and Governance

05 - Organizational Change Management - Unite and Thrive

Utilize the Organizational Change Management module to unite your team and thrive through effective, sustainable change.

Key Features:

• Change Impact Assessment: OCM helps assess how strategic changes

(e.g., mergers, acquisitions, digital transformation) will impact employees,

culture, operations, and stakeholders across portfolio companies.

• Stakeholder Engagement: Involves active engagement of key stakeholders,

including management teams, employees, investors, and external partners,

ensuring alignment and buy-in for transformational initiatives.

• Change Communication Strategy: Develops clear communication plans to

inform and guide employees and stakeholders through the transition

process, ensuring clarity and minimizing confusion during the change.

Importance:

• Enabling Successful Transformation: Private equity-backed companies often

undergo significant changes, including restructuring, acquisitions, or digital

upgrades. OCM ensures these changes are implemented successfully and

efficiently.

• Faster Value Creation: Effective OCM helps private equity firms drive faster

value creation by ensuring that portfolio companies can adapt quickly to

strategic changes, whether operational, technological, or organizational.

• Mitigating Risk: Managing change effectively reduces the risk of operational

disruption, financial underperformance, or resistance from employees during

significant transitions, protecting the value of the investment.

Benefits:

• Increased Operational Efficiency: By managing changes effectively, OCM

helps portfolio companies adopt new processes, technologies, or strategies

that improve efficiency, reduce costs, and streamline operations.

• Higher Employee Engagement: With proper communication, training, and

support, employees are more likely to embrace changes, resulting in higher

engagement, productivity, and lower turnover during and after the transition.

• Improved Financial Performance: OCM ensures that changes lead to

improved financial outcomes by minimizing disruptions, ensuring faster

adoption of new processes, and optimizing operational performance across

portfolio companies.

Benefits:

• Increased Efficiency: Centralizing communications and reporting streamlines

workflows, reducing the time spent on administrative tasks and improving

the overall efficiency of private equity firms and their portfolio companies.

• Stronger Investor Confidence: With real-time updates and transparent

communication, investors are more confident in the private equity firm’s

ability to manage the portfolio effectively and drive value creation.

• Better Collaboration: The hub promotes better collaboration between

portfolio company leadership teams, private equity professionals, and other

stakeholders, ensuring that all parties are aligned on key strategies and

objectives.

06 - Engagement Hub - Share and Guide

Utilize the Engagement Hub to streamline your communication, enhance team collaboration, and guide your organization through successful transformations.

Key Features:

• Centralized Communication Platform: The Engagement Hub acts as a

unified platform for all stakeholders—investors, portfolio company

management, and internal teams—to communicate and share information,

ensuring transparency and alignment.

• Real-Time Collaboration: Enables real-time collaboration between private

equity teams and portfolio companies, facilitating efficient decision-making,

strategy discussions, and issue resolution across different geographies and

time zones.

• Stakeholder Engagement Tracking: Tracks interactions with investors,

portfolio companies, and other partners, helping private equity firms monitor

the effectiveness of their engagement and ensuring all parties are aligned.

Importance:

• Improved Stakeholder Communication: Private equity involves multiple

stakeholders (investors, portfolio companies, advisors, etc.), making

seamless communication crucial.

• The Engagement Hub ensures transparency and alignment across all

parties.

• Centralized Information Access: A centralized hub consolidates all data,

performance reports, and communication in one platform, ensuring that

investors and portfolio companies have easy access to real-time information

and updates.

• Faster Decision-Making: The hub facilitates faster decision-making by

providing real-time performance metrics, streamlined communication

channels, and collaboration tools that enhance the agility of private equity

firms.

Transformation As Usual Capability Model

Individual and Team Capability Development