Banking Services – Enterprise Business Transformation

An Introduction To Our Banking Services Platform

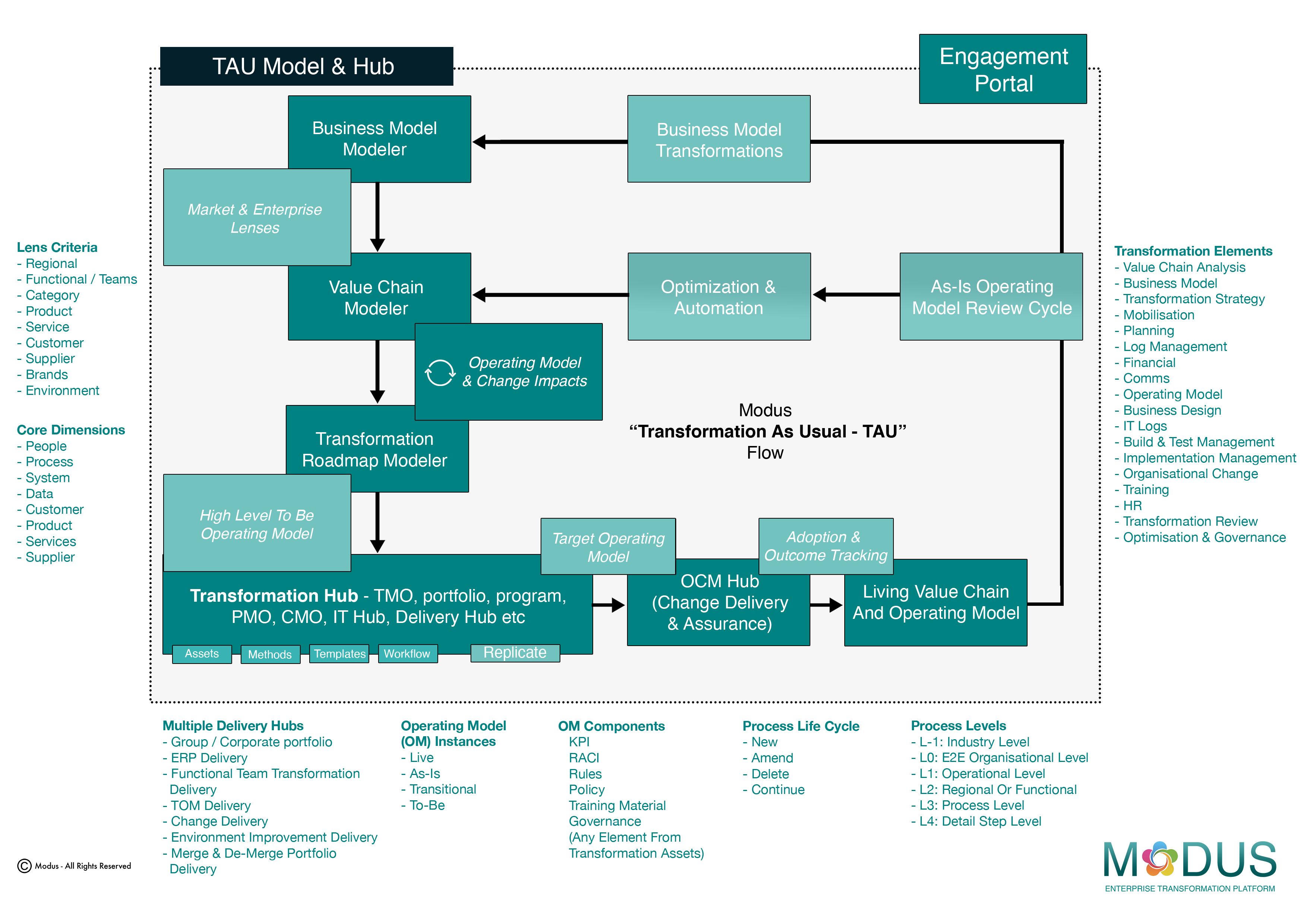

Modus Business Transformation Core Modules

Building, Driving and Sustaining your Business Transformation and embedding a 'Transformation As Usual' platform.

01 - Business Model Management - Manage and Adapt

Embrace the Business Model Management Hub to navigate and thrive in the ever-evolving business landscape with confidence and clarity.

Key Features:

• Value Chain Modeling: A crucial tool for analyzing and managing financial

processes, identifying dependencies, and aligning business objectives with

operations across departments.

• Transformation Strategy Setup: It focuses on aligning strategic goals with

execution frameworks, ensuring the bank’s operating models reflect the

desired business outcomes.

• Financial Dashboards and Forecasting: Continuous tracking of financial

performance, risks, and KPIs to provide real-time insights into profitability,

budgeting, and asset management.

Importance:

• Operational Efficiency: By managing business models effectively, banks

streamline their operations, making workflows more efficient and reducing

costs.

• Strategic Alignment: It ensures that the bank’s business models are closely

aligned with strategic goals, fostering agility in responding to market c

changes and competitive pressures.

• Regulatory Compliance: Business model management supports adherence

to financial regulations, enhancing transparency and mitigating risks

associated with non-compliance.

Benefits:

• Improved Decision-Making: Through comprehensive data and financial

performance tracking, banks gain deeper insights, enabling faster and more

informed decisions.

• Enhanced Customer Experience: By leveraging value chain modeling and

business transformation, banks can better tailor services to customer needs,

increasing satisfaction and loyalty.

• Agility and Innovation: Effective business model management encourages

continuous improvement and innovation, allowing financial institutions to

adapt swiftly to technological advancements and market dynamics.

Benefits:

• Operational Efficiency: By identifying bottlenecks and inefficiencies, the

Value Chain Modeler helps banks optimize workflows and reduce costs.

• Regulatory Compliance: The ability to track financial data and processes

ensures that banks can meet regulatory requirements more easily, reducing

the risk of non-compliance penalties.

• Informed Decision-Making: The real-time data integration and forecasting

capabilities enable banking leaders to make data-driven decisions,

improving both day-to-day operations and long-term strategic planning.

02 - The Value Chain Modeler - Manage and Adapt

Harness the power of the Value Chain Modeler to drive your business forward with clarity, precision, and confidence.

Key Features:

• End-to-End Financial Process Mapping: The Value Chain Modeler offers a

detailed mapping of all financial processes, from customer acquisition to

product delivery, allowing for precise identification of interdependencies

across departments (e.g., loans, investment, risk management).

• Integration with Business Models: It links the value chain to the broader

business model, aligning financial services, operational workflows, and

customer interactions with the bank’s strategic goals.

• Real-Time Data Integration: Incorporates financial data from various sources

(e.g., treasury, risk, accounting) to monitor key metrics, providing a

comprehensive view of the bank’s operational efficiency and financial health.

Importance:

• Alignment of Strategy with Operations: The Value Chain Modeler ensures

that banking operations are tightly aligned with strategic objectives, fostering

agility in decision-making and responsiveness to market changes.

• Improved Risk Management: By visualizing the end-to-end processes,

banks can better identify risks and inefficiencies, ensuring more effective

management of both financial and operational risks.

03 - The Operating Model - Organize and Sustain

Utilize the Operating Model to keep your business operations organized, efficient, and adaptable, ensuring long-term success and growth.

Key Features:

• Target Operating Model (TOM): Defines the future state of the bank’s

operations, linking strategic goals with organizational functions. This includes

processes, systems, roles, data, and KPIs.

• End-to-End Process Management: The operating model captures and

integrates all financial processes, from customer-facing services (e.g.,

account management, loan origination) to back-office operations (e.g., risk

management, compliance).

• System and Data Integration: Incorporates IT systems, data flows, and

financial tools, ensuring smooth coordination across platforms (e.g., CRM,

ERP, compliance systems) to maintain operational consistency.

Importance:

• Alignment with Strategic Goals: The operating model ensures that all

banking functions and processes are aligned with the overall strategy,

enabling efficient execution of strategic objectives.

• Improved Regulatory Compliance: By integrating regulatory requirements

into the operating model, banks can better manage compliance, reducing the

risk of penalties and enhancing trust with regulators.

• Risk Management: Ensures that risks related to operations, financial

performance, and customer interactions are managed through a

comprehensive view of processes and systems.

Benefits:

• Operational Efficiency: The model helps banks streamline their processes,

eliminate inefficiencies, and reduce costs through better resource

management and process automation.

• Enhanced Agility: With the ability to adapt the operating model to changing

market conditions or regulatory demands, banks can remain competitive and

responsive to external challenges.

Benefits:

• Enhanced Efficiency and Productivity: Automation of project management

tasks, such as reporting, planning, and resource allocation, reduces manual

effort and improves the efficiency of transformation initiatives.

• Increased Agility in Transformation: By offering a flexible framework for

project management, the module.

04 - The Transformation Assets and Portfolio Module - Discover and Transform

Leverage the Transformation Assets and Portfolio Module to drive successful and sustainable business transformations with clarity and efficiency.

Key Features:

• Centralized Asset Bank: This module provides access to a comprehensive

repository of over 400 transformation assets, including methodologies, tools,

templates, and frameworks tailored to banking operations (e.g., compliance,

risk management, customer service).

• Integrated Portfolio Management: Manages a suite of projects within the

transformation portfolio, ensuring each initiative is aligned with strategic

goals. It offers centralized visibility and control over various transformation

efforts (e.g., digital transformation, regulatory changes).

Importance:

• Alignment with Strategic Transformation: The module ensures that all

transformation activities, whether operational or digital, are aligned with the

bank’s broader strategic objectives, such as growth, compliance, and

customer satisfaction.

• Improved Governance and Oversight: With centralized project oversight, the

module ensures that projects are executed with greater accountability,

reducing the risk of delays or failures due to mismanagement or

misalignment.

• Value Chain Analysis

• Business Model Analysis

• Transformation Strategy

• Transformation Mobilisation

• Planning Management

• Transformation Log Management

• Financial Management

• Communication Management

• Operating Model Management

• Process Design Management

• IT Design Management

• Build and Test Management

• Implementation Management

• Change Management

• Personal Development Assessments

• Training Management

• Organizational Design Management

• Transformation Review

• Optimization and Governance

05 - Organizational Change Management - Unite and Thrive

Utilize the Organizational Change Management module to unite your team and thrive through effective, sustainable change.

Key Features:

• Structured Change Methodology: The OCM module provides a

comprehensive framework for managing change across the entire bank,

from strategic alignment to execution. It includes predefined tools, templates,

and methods for consistent change management.

• Stakeholder Engagement Tools: Tools for identifying, engaging, and

managing stakeholders, ensuring all key parties (e.g., employees,

customers, regulators) are informed and aligned throughout the change

process.

• Role-Specific Training and Adoption Plans: Customized training and role-

specific adoption plans to ensure that employees across the organization

understand and embrace the changes being implemented.

Importance:

• Alignment of Change with Business Goals: Ensures that organizational

changes are aligned with the bank’s strategic goals, whether they involve

new regulations, digital transformation, or operational improvements.

• Minimization of Disruption: By carefully managing change processes and

engaging all relevant stakeholders, the OCM module helps to minimize

operational disruptions, ensuring that critical banking services continue

without interruption.

Benefits:

• Faster Adoption of Changes: With role-specific training and clear

communication plans, the OCM module accelerates the adoption of new

processes, systems, and regulatory requirements across the organization.

• Improved Employee Engagement: The structured change management

approach fosters greater engagement and reduces resistance among

employees, making it easier for them to adapt to new roles, responsibilities,

or technologies.

Benefits:

• Increased Productivity: By centralizing access to all relevant information and

providing tools for collaboration, the hub boosts productivity, allowing teams

to focus on execution rather than chasing updates or approvals.

• Faster Decision-Making: With real-time access to transformation progress

and key project data, banking leaders can make faster, more informed

decisions, driving smoother execution of changes.

• Improved Stakeholder Engagement: The hub allows better management of

stakeholder relationships by providing timely updates and ensuring that all

concerns or feedback are addressed promptly, leading to higher levels of

engagement and satisfaction.

06 - Engagement Hub - Share and Guide

Utilize the Engagement Hub to streamline your communication, enhance team collaboration, and guide your organization through successful transformations.

Key Features:

• Centralized Communication Platform: The Engagement Hub provides a

single interface for all communication related to banking transformation

projects, offering access to reports, updates, and project progress in real-

time.

• User-Specific Dashboards: Tailored dashboards for different roles (e.g.,

executives, project managers, team members), providing relevant and up-to-

date information to each user based on their responsibilities within the

transformation process.

• Collaboration Tools: Enables cross-team and cross-department

collaboration, ensuring that banking professionals can work together

seamlessly on shared goals, whether they’re located in different regions or

departments.

Importance:

• Transparency: Provides all stakeholders (employees, customers, regulators)

clear visibility into the transformation, building trust.

• Efficient Communication: Centralizes updates to avoid silos and ensure

consistent information across teams.

• Enhanced Collaboration: Facilitates cross-functional coordination between

key areas like IT, risk, and compliance, essential for transformation success.

Transformation As Usual Capability Model

Individual and Team Capability Development